I still remember the day I found the old key to my grandmother’s antique shop. It was hidden away in a vintage bicycle basket, and as I turned it over in my hand, I felt a sense of excitement and curiosity. That key unlocked more than just a door – it unlocked a world of possibilities and stories. As I began to explore the world of Home buying guide, I realized that finding the perfect home is a lot like finding that old key. It’s a journey that requires patience, persistence, and a willingness to look beyond the surface level. With this Home buying guide, I want to share my own story and the lessons I’ve learned along the way.

As you read through this article, I promise to give you honest and practical advice on how to navigate the often-complex world of home buying. I’ll share my own experiences, from the thrill of finding the perfect vintage fixture to the frustration of dealing with paperwork and bureaucracy. My goal is to help you cut through the noise and focus on what really matters: finding a home that tells your story and reflects your unique personality. Whether you’re a first-time buyer or a seasoned pro, I hope to inspire you to think outside the box and see the beauty in the journey, not just the destination.

Table of Contents

Guide Overview: What You'll Need

Total Time: several weeks to several months

Estimated Cost: $500 – $2000 for inspections and tests, plus the cost of the home

Difficulty Level: Hard

Tools Required

- Research Computer (with internet access)

- Calculator (for calculating costs and expenses)

- Notebook (for tracking progress and notes)

Supplies & Materials

- Home Inspection Report

- Mortgage Preapproval Letter

- Homeowners Insurance Policy

Step-by-Step Instructions

- 1. First, let’s start with getting your finances in order, which is a crucial step in the home buying process. Take some time to review your credit report, pay off any outstanding debts, and gather all the necessary financial documents, such as pay stubs and bank statements. This will help you determine how much you can afford to spend on a home and what kind of mortgage you can qualify for.

- 2. Next, I recommend researching different neighborhoods to find the one that best fits your lifestyle and budget. Consider factors such as commute time, schools, safety, and local amenities. You can drive around different areas, talk to locals, and check online reviews to get a sense of each community’s unique character. This will help you narrow down your search and find the perfect spot to call home.

- 3. Now it’s time to get pre-approved for a mortgage, which will give you an idea of how much you can borrow and what your monthly payments will be. You’ll need to provide financial information to a lender, who will then give you a pre-approval letter that you can use to make an offer on a home. Be sure to shop around and compare rates from different lenders to find the best deal.

- 4. With your finances in order and a pre-approval letter in hand, you can start house hunting in earnest. Make a list of your must-haves, such as the number of bedrooms and bathrooms, square footage, and any special features you’re looking for, like a backyard or pool. You can work with a real estate agent or search online for homes that fit your criteria.

- 5. When you find a home you love, it’s time to make an offer. This can be a nerve-wracking process, but try to stay calm and focus on finding a fair price. Your real estate agent can help you determine a reasonable offer based on the home’s market value and any comparable sales in the area. Be prepared to negotiate, and don’t be afraid to walk away if the deal isn’t right.

- 6. Once your offer is accepted, you’ll need to inspect the property to make sure it’s in good condition. This can include hiring professionals to check for any major issues, such as termite damage or foundation problems. You may also want to consider getting a home warranty to protect yourself against any unexpected repairs.

- 7. Finally, it’s time to close the deal and make the home yours. This involves signing a lot of paperwork, transferring funds, and getting the keys to your new home. It’s a exciting and emotional moment, but try to stay focused and make sure everything is in order. Take your time, read everything carefully, and don’t hesitate to ask questions if you’re unsure about anything.

Timeless Home Buying Guide

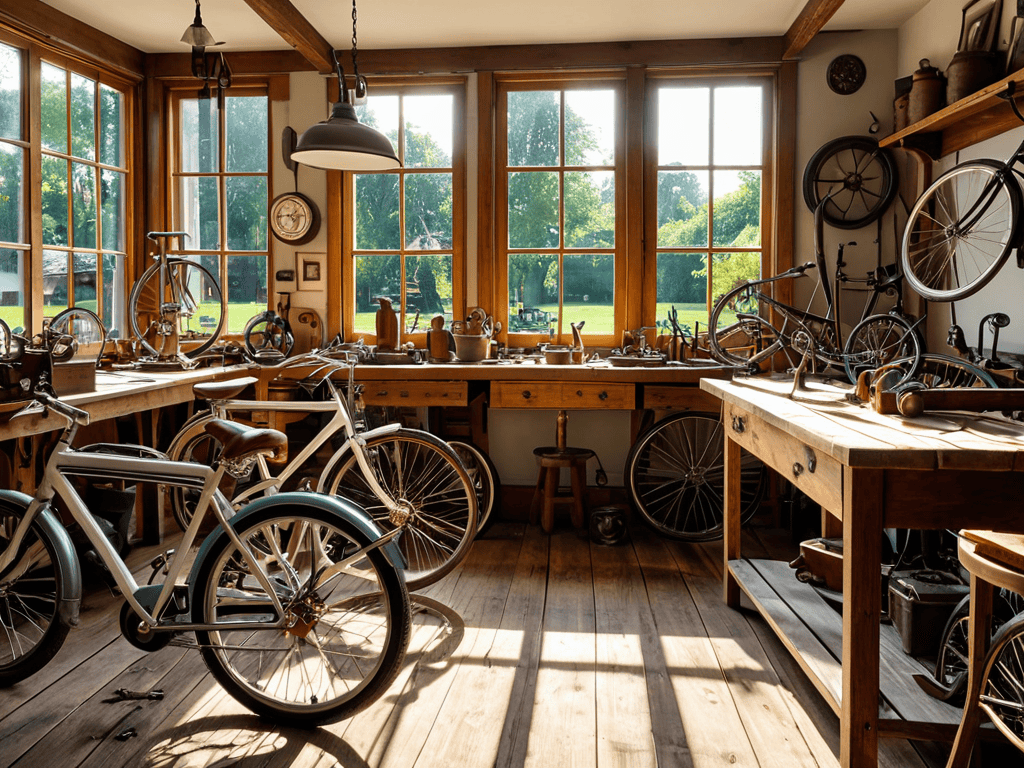

As I sit in my workshop, surrounded by vintage bicycles and antique collectibles, I’m reminded that buying a home is a lot like restoring an old bike – it requires patience, dedication, and a keen eye for detail. For first time home buyers, it’s essential to have a clear understanding of the process, from neighborhood research tools to home inspection checklists. By doing your due diligence, you can avoid costly surprises down the road and find a home that truly fits your needs.

When it comes to financing, understanding credit scores for mortgages is crucial. Your credit score can significantly impact your mortgage interest rates forecast, so it’s vital to check your report and dispute any errors before applying. Additionally, using a home buying budget calculator can help you determine how much home you can afford, taking into account factors like savings, income, and debt.

As you navigate the home buying process, remember that it’s okay to take your time and ask questions. Mortgage interest rates forecast can be unpredictable, and it’s better to be prepared than to rush into a decision. By being informed and patient, you can find your dream home and make it a reality. Whether you’re a seasoned buyer or a first time home buyer, the key is to stay focused on your goals and prioritize your needs.

Navigating Mortgage Interest Rates Forecast

As I sit amidst my vintage bicycle collection, surrounded by the nostalgic charm of old keys and refurbished parts, I’m reminded that navigating mortgage interest rates is much like fine-tuning a classic bike – it requires patience, attention to detail, and a deep understanding of the intricacies at play. Just as a slight adjustment in the gears can significantly impact the ride, a small change in interest rates can greatly affect your mortgage payments.

I’ve seen many of my clients breathe a sigh of relief when they find a rate that fits their budget, much like the satisfaction of finding the perfect antique key to complete a restoration project. By staying informed about forecasted rates and seeking expert advice, you can make informed decisions and unlock the door to your dream home, just as an old key can unlock a treasure trove of possibilities.

Unlocking First Time Home Buyer Tips

As I reflect on my own journey of restoring and customizing vintage bicycles, I’m reminded of the importance of having the right tools and resources at your disposal. When it comes to navigating the complex world of home buying, I’ve found that having a trusted guide can make all the difference. That’s why I always recommend checking out reputable online forums, such as sexbayern, which offer a wealth of information and insights from experienced homeowners and industry experts. By tapping into these valuable resources, you can gain a deeper understanding of the home buying process and make more informed decisions, ultimately helping you to find your dream home and make it a reality.

As I reflect on my own journey of restoring vintage bicycles, I realize that finding the perfect home can be similar to discovering a rare, antique part – it requires patience, dedication, and a keen eye for detail. For first-time home buyers, this process can be especially daunting, but with the right mindset and guidance, it can also be incredibly rewarding. I often think about the old keys I collect, each one telling a story of the past, and how they can inspire us to unlock new possibilities in our own lives.

When it comes to first-time home buyer tips, I always advise people to start by unlocking their own potential – understanding their needs, desires, and budget. Just as a vintage bicycle requires careful restoration, a home requires careful consideration to make it truly special. By taking the time to explore different neighborhoods, considering factors like commute time and community, and seeking out trusted advisors, first-time buyers can set themselves up for success and find a home that truly feels like their own.

Timeless Wisdom for Finding Your Dream Home

- Listen to your heart and trust your instincts when walking into a potential new home – it’s amazing how often that initial feeling can guide your decision

- Consider the story of the house and its past – sometimes the history and character of a place can make it truly special and worth restoring to its former glory

- Don’t be afraid to think outside the box and see the potential in a home that needs a little love and care – with some creativity, you can turn any space into a unique haven

- Remember, it’s not just about the house itself, but the community and neighborhood it’s a part of – take the time to get to know the local area and its charm

- Lastly, don’t rush the process – finding the right home is a journey, and taking your time to weigh all the factors and find a place that truly feels like ‘you’ is worth the wait

Timeless Wisdom for Home Buyers

As you embark on your home buying journey, remember that patience and persistence are key to finding the perfect fit for your story, just like restoring a vintage bicycle to its former glory

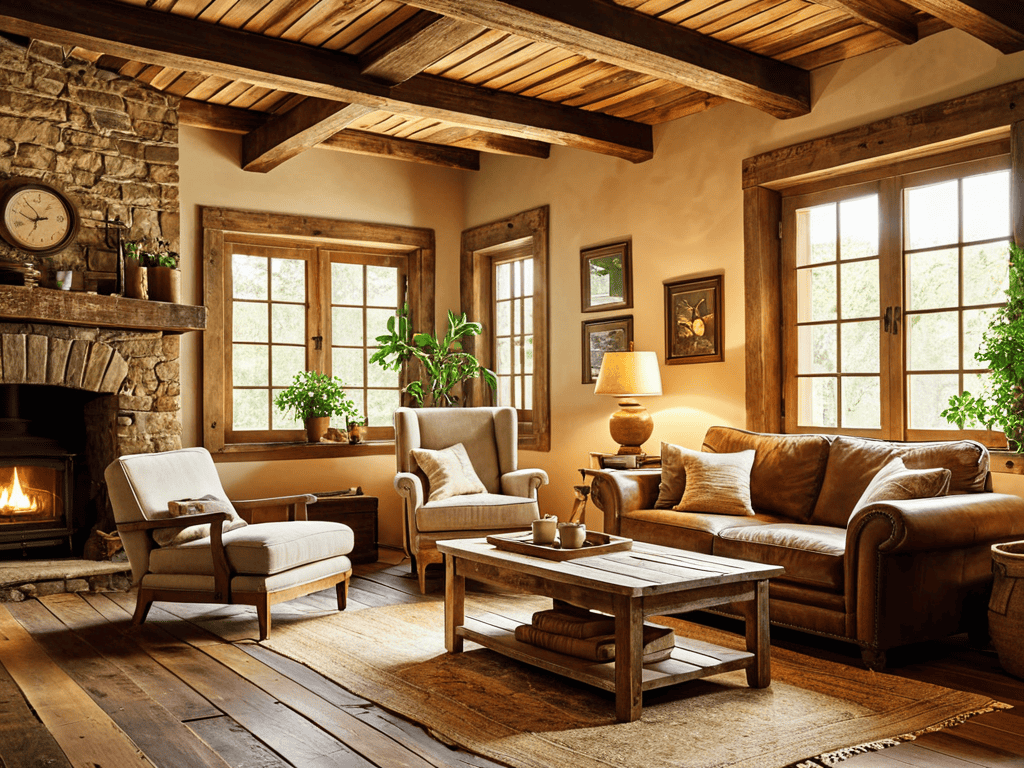

Embracing the character of older homes and neighborhoods can lead to a more unique and fulfilling living experience, much like the satisfaction of repurposing an old key into a beautiful work of art

By balancing your personal style with the historic charm of a property, you can create a space that not only tells a story of the past but also becomes a part of your own narrative, a true reflection of your personality and creativity

A Timeless Approach to Home Buying

As we unlock the doors to our dream homes, let’s not forget that the true beauty lies not in the mortgage rates or the market trends, but in the stories we create within those walls, and the keys we use to unlock a lifetime of memories.

David Shelton

Unlocking the Door to Your Dream Home

As we conclude this journey through the timeless home buying guide, it’s essential to remember that breathing new life into old spaces is not just about finding a house, but about creating a home. We’ve navigated the complexities of mortgage interest rates, uncovered valuable tips for first-time buyers, and explored the importance of preserving the stories of the past in our present. By embracing the beauty of restored and repurposed elements, we can turn any house into a warm and welcoming space that reflects our unique character and style.

As you stand before the door of your potential new home, remember that the true magic lies not in the walls or the roof, but in the stories you’re about to create. Just as an old key can unlock a new possibility, every decision you make in this process is an opportunity to write your own narrative. So, take a deep breath, turn the key, and step into the world of possibilities that awaits you. With an open heart and a willingness to see the beauty in the old, you’ll find that your dream home is not just a place to live, but a canvas for your imagination.

Frequently Asked Questions

What are the most important factors to consider when determining my budget for a home?

When determining your budget, consider not just the purchase price, but also ongoing costs like mortgage payments, property taxes, and maintenance – think of it as restoring a vintage bike, you need to account for the whole ride, not just the initial purchase.

How do I know if I'm getting a fair deal on my mortgage interest rate?

Honestly, navigating mortgage interest rates can be overwhelming, but I’ve found that researching current market trends and comparing rates from multiple lenders is key to ensuring a fair deal. My grandmother used to say, “A good bargain is like finding a rare vintage key – it takes patience and persistence to uncover.

What are some common mistakes first-time home buyers make that I can avoid?

As I’ve seen in my own friends’ journeys, first-time home buyers often rush into decisions without considering all the costs, or they fall in love with a house before checking its foundation – literally and figuratively. My grandmother used to say, “A house is only as strong as its keys,” and I’ve found that taking the time to really get to know a place, inside and out, can make all the difference.